The US biotech and life sciences sector has become a global powerhouse, driven by cutting-edge innovation, a highly skilled workforce, and a supportive regulatory environment. This dynamic sector not only addresses critical health challenges but also attracts billions in Foreign Direct Investment (FDI) annually.

A Look Back: Challenges and Resilience

Historically, the biotech and life sciences industry faced significant hurdles, including high R&D costs, lengthy regulatory approval processes, and market access challenges. The early 2000s saw many biotech startups struggle with scaling due to limited funding and investor skepticism about long-term profitability.

Despite these challenges, the sector has demonstrated remarkable resilience, supported by robust intellectual property protections, public-private partnerships, and a growing emphasis on personalised medicine. These factors have helped build investor confidence, leading to consistent FDI growth over the past decade.

Current FDI Trends in Biotech and Life Sciences

1. Increasing Focus on Precision Medicine

The shift toward precision medicine—tailoring treatments to individual genetic profiles—has driven FDI in the US. Companies like Novartis and Roche have invested heavily in US facilities to advance personalized treatments for cancer and rare diseases.

2. Vaccine and Therapeutic Development

The COVID-19 pandemic underscored the importance of agile vaccine and therapeutic development. The US emerged as a global leader, attracting investments from international firms such as Sanofi and GlaxoSmithKline, which partnered with US-based companies to accelerate vaccine production.

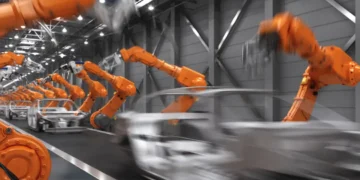

3. Expansion of Biomanufacturing Facilities

Foreign investors are increasingly targeting the biomanufacturing segment, which involves producing biological products like antibodies and cell therapies. Samsung Biologics, a South Korean firm, recently expanded its presence in the US, investing in advanced manufacturing facilities in Texas.

4. Growth of Health Tech and Digital Health

The integration of technology into healthcare has attracted tech-savvy investors. Companies such as SoftBank have funded US-based health tech startups like 23andMe, which blend biotechnology with digital platforms.

Key Investment Destinations

Massachusetts: The Biotech Hub

Massachusetts, home to the renowned Kendall Square in Cambridge, is often referred to as the “epicenter of biotech.” Companies like Pfizer, Moderna, and Takeda Pharmaceuticals have invested heavily in the region.

- Why Massachusetts?

- Proximity to top research institutions like MIT and Harvard.

- A dense cluster of biotech startups and established companies.

- Strong state-level support and tax incentives.

California: Innovation and Scale

California boasts a thriving biotech ecosystem, particularly in the San Francisco Bay Area and San Diego. Amgen, Genentech, and Illumina are among the major players driving innovation in the state.

- Why California?

- High concentration of venture capital funding.

- Access to a diverse and skilled talent pool.

- Cutting-edge research facilities.

North Carolina: Biotech’s Emerging Leader

The Research Triangle Park (RTP) in North Carolina has become a magnet for life sciences investment. Companies like Biogen and Fujifilm Diosynth Biotechnologies have expanded operations in the state.

- Why North Carolina?

- Competitive operational costs.

- World-class research universities.

- State incentives for life sciences development.

Comparative Data Table

| State | Notable Companies | Key FDI Projects |

|---|---|---|

| MA | Moderna, Pfizer, Takeda | Pfizer’s $600M R&D expansion in Cambridge |

| CA | Amgen, Genentech, Illumina | Genentech’s $450M manufacturing site expansion |

| NC | Biogen, Fujifilm Diosynth | Fujifilm’s $2B investment in RTP |

| TX | Samsung Biologics, Novartis | Samsung’s biomanufacturing plant in Houston |

| PA | GSK, Merck | Merck’s $1B vaccine manufacturing facility |

Opportunities for Foreign Investors

1. Public-Private Partnerships

Collaborations between government agencies, universities, and private companies create a fertile ground for innovation. Programs like the NIH’s Accelerating Medicines Partnership offer foreign investors opportunities to engage in groundbreaking research.

2. Emerging Therapeutic Areas

Foreign investors are keenly interested in areas like gene therapy, oncology, and rare diseases. With its leadership in these fields, the US offers unparalleled investment opportunities.

3. Workforce Development

The US life sciences workforce is among the most skilled globally. Initiatives like North Carolina’s NCBioImpact provide targeted training to meet the sector’s growing demands.

Challenges to Consider

Despite its many advantages, the US biotech sector poses challenges, including:

High R&D Costs: The average cost of developing a new drug is estimated at $2.6 billion.

Regulatory Complexity: Foreign investors must navigate FDA requirements and state-level regulations.

Talent Competition: High demand for skilled professionals can drive up labor costs.

Future Outlook

The US biotech and life sciences sector is poised for continued growth, fueled by advancements in technology, supportive policies, and global health priorities. FDI is expected to play a critical role in sustaining this momentum, with emerging markets within the US—such as Texas and Pennsylvania—offering untapped potential.